As we approach 2026, the commercial lending landscape remains in flux. Interest rates remain elevated, borrower behaviors are shifting, and institutions face continued pressure to modernize legacy processes. For banks and credit unions, the environment also brings heightened regulatory scrutiny, especially around portfolio concentrations, and increased competition for high-quality credit.

Yet opportunity remains for lenders who prioritize portfolio control, disciplined growth, and operational modernization. Observing trends among GoDocs’ customers and broader industry data, six strategies stand out as ways for regulated lenders to strengthen portfolios and reduce risk exposure. These are not about chasing short-term trends. They’re about making strategic moves that deliver stability and performance across cycles.

1. DSCR Lending for Portfolio Stability

Debt Service Coverage Ratio (DSCR) lending continues to hold its ground, even as other asset classes soften. While DSCR loans have historically been associated with private credit and SFR investors, banks and credit unions are increasingly leveraging DSCR lending to diversify portfolios and generate steady, amortizing cash flows.

In a rising rate environment, DSCR loans offer predictable income streams, amortizing structures, and lower default correlations compared to more speculative CRE or transitional loans. Community and regional banks, in particular, are finding DSCR attractive as they seek alternatives to traditional CRE segments like office and hospitality, which face structural headwinds.

Modern origination technology makes it easier for regulated institutions to underwrite and service DSCR loans efficiently, bringing them closer in line with private lending in terms of speed and borrower experience. By embedding DSCR lending into their strategies, institution lenders can enhance portfolio stability without materially increasing credit risk, a key objective as regulators scrutinize CRE concentrations and interest rate risk.

2. Geographic Expansion to Balance Concentrations

Not all regions are created equal. While some metros face persistent office vacancies and pricing resets, others, such as Texas, the Midwest, and emerging logistics hubs are showing resilience and growth. Expanding into new geographies allows institutions to balance concentration risk, capture growth markets, and position for future expansion without overexposure to any one metro or asset type.

A study by researchers at the Wharton School examined how geographic diversification impacts bank performance, particularly in the wake of financial crises and regulatory changes. They found that the most geographically diversified banks achieved:

- A nearly 17% increase in small business lending compared to banks that did not take advantage of deregulation to expand into new states.

- 6.7% greater total lending than the least diversified banks following the 2008 financial crisis.

Recent trends show credit unions moving from state-chartered to federal structures, unlocking the ability to lend nationwide. This shift allows regulated lenders to strategically diversify their CRE portfolios across state lines, leveraging technology platforms to handle multistate compliance and operational complexity with greater ease.

3. Sector-Specific Growth in Innovation-Driven Industries

Innovation-focused sectors, such as biotechnology, pharmaceuticals, advanced manufacturing, and data infrastructure, continue to attract capital and drive demand for specialized CRE financing. These sectors are often less cyclical than traditional CRE, making them valuable anchors in uncertain times.

For example, Amgen recently announced a $650 million U.S. production expansion, underscoring sustained demand for specialized facilities. Community and regional lenders can participate in this growth through construction loans for advanced facilities, equipment-backed leases, or redevelopment financing for older industrial stock.

Some institutions are entering these sectors through loan participation networks and CUSOs, allowing them to share exposure and expertise without taking on excessive concentration risk individually. By targeting specialized industries, lenders can stabilize performance through credit tied to durable tenant demand and long-term investment commitments.

4. Rising SBA Lending Demand as a Risk-Managed Growth Channel

Small businesses remain the backbone of the U.S. economy, accounting for 99.9% of all U.S. businesses. In uncertain times, many of these businesses turn to SBA 7(a) and 504 financing for capital with flexible terms and partial federal guarantees. For banks and credit unions, SBA lending offers risk-weighting advantages, secondary market liquidity, and portfolio diversification.

Lending institutions that invest in modernizing SBA origination and servicing; automating documentation, eligibility checks, and closing processes, are seeing faster approvals, higher borrower retention, and reduced credit exposure. With SBA volumes continuing to grow, lenders that build efficient SBA programs are positioned to capture market share while managing risk prudently.

5. Multifamily Lending Resilience Amid Supply Peaks

Multifamily remains the largest single CRE exposure for many regulated lenders, and 2025–2026 is a pivotal period for the sector. A surge of new supply is peaking in many Sunbelt markets, creating rent growth headwinds, especially in Class A segments. However, fundamentals remain sound in stabilized Class B and workforce housing, particularly in supply-constrained metros.

Multifamily economist Jay Parsons has highlighted that despite elevated construction pipelines, absorption remains steady in many markets, and lease trade-outs are holding for stabilized assets outside of oversupplied submarkets. For banks and credit unions, this underscores the importance of disciplined underwriting, focusing on stabilized DSCR, sponsor liquidity, and conservative rent growth assumptions.

Multifamily lending remains a core income generator for regulated institutions. By differentiating between speculative lease-up projects and stabilized, income-producing assets, lenders can continue to allocate capital to this sector with measured confidence, capturing durable income streams while managing cyclicality.

6. C&I and Business Asset Lending as a Diversification Lever

As regulators increase scrutiny of CRE concentrations, many institutions are turning to Commercial & Industrial (C&I) lending, secured by business assets rather than real estate, as a strategic complement to their portfolios. C&I lending offers floating rates, shorter durations, and collateral diversification, helping lenders rebalance portfolios without curtailing credit activity.

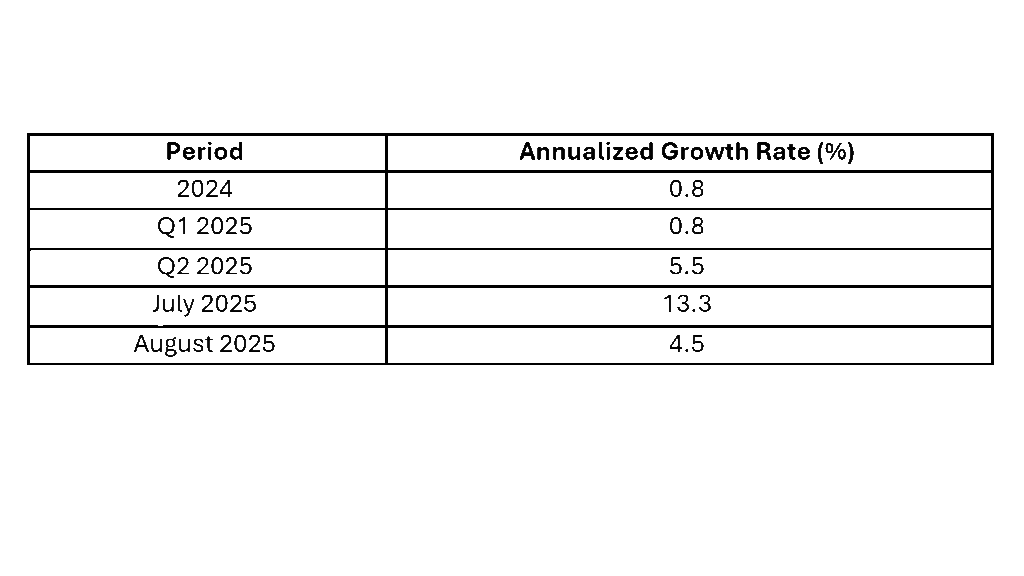

According to the Federal Reserve’s H.8 data, Commercial & Industrial (C&I) loan growth was slow through 2024 and early 2025, with annualized growth rates around 0.8%. Growth then accelerated significantly in mid-2025, peaking at 13.3% annualized growth in July before moderating to 4.5% in August. C&I loans, typically secured by equipment, accounts receivable, and inventory, often include borrowing bases and covenants that provide early warning of credit stress, unlike commercial real estate loans, which tend to reveal problems later. For banks nearing regulatory concentration limits on commercial real estate, expanding C&I lending offers a key diversification strategy that can mitigate regulatory risk, enhance net interest margins, and support local economic growth.

Implementing These Strategies for Future-Proof Resilience

The commercial lending landscape is constantly shifting, and institutions that actively integrate DSCR lending for stability, expand geographically, target specialized sectors, leverage SBA programs, apply strategic multifamily underwriting, and grow C&I lending can build portfolios that withstand market cycles and capitalize on new opportunities.

GoDocs can help you operationalize these approaches efficiently, streamlining processes, improving compliance, and accelerating loan decisions. Connect with us to learn how we support your journey to resilient, growth-oriented lending.

Experience the Future of Commercial Loan Document Automation

Discover GoDocs, the leading SaaS solution powered by the sharpest legal minds in CRE! Schedule a demo today to elevate your lending process and to gain your competitive advantage.

VP, Operations at GoDocs