Product

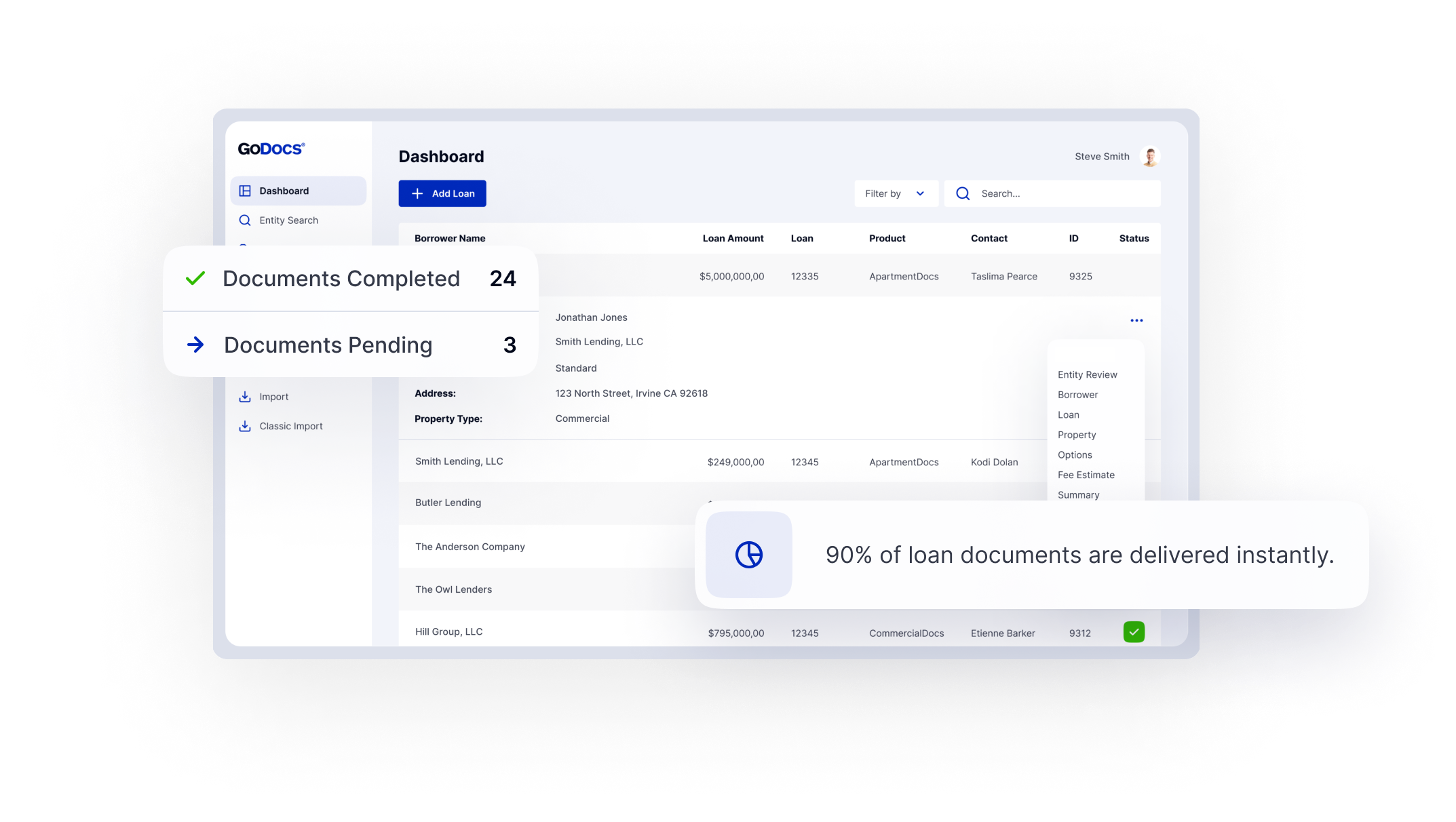

Integrating with your existing LOS, GoDocs provides an automated SaaS solution for generating attorney-quality closing documents in minutes.

Committed to our customers’ security: With our SOC 2 Type II certification, you can trust your data is shielded beyond traditional safeguards, ensuring the highest level of data security and reliability.

Learn moreSolutions

GoDocs modernizes commercial loan closings and makes the process of reviewing the ever-changing legal and regulatory landscape simple.

By leveraging the right strategies, financial institutions can not only weather the storm but position themselves as leaders in the market.

Learn moreLenders

Commercial lenders using GoDocs gain a faster, more reliable solution that delivers consistent, accurate, and fully compliant documents

Our latest Budget Playbook for Commercial Lenders was crafted to help banks and credit unions find answers. In it, we delve into the most pressing challenges facing commercial lenders today with a practical guide to help your institution thrive, regardless of market volatility.

Learn moreAbout Us

GoDocs puts lenders in control of the lending process and eliminates the stress of generating consistent quality commercial closing documents.

Discover the full potential of your commercial lending operations with our comprehensive guide.

Learn moreResources

Founded by legal and SaaS experts, GoDocs provides insights into commercial lending trends and resources to help your organization stay ahead of market shifts.

View All Resources

Our latest Budget Playbook for Commercial Lenders was crafted to help banks and credit unions find answers. In it, we delve into the most pressing challenges facing commercial lenders today with a practical guide to help your institution thrive, regardless of market volatility.

Learn more