Here’s why it’s time to prioritize progress. Backed by data, expert advice, and real market trends.

The commercial lending sector faces a crossroads. While some lenders cling to legacy systems and “safe” manual workflows they’ve been using for decades, the market and regulatory environment are evolving too quickly for this approach to remain viable. As GoDocs and other industry experts consistently warn, the real risk is failing to modernize.

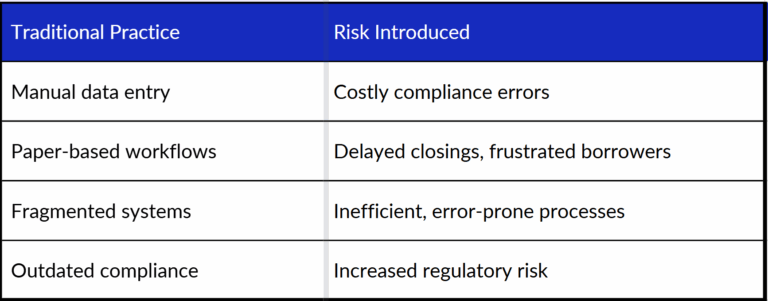

Manual processes and legacy systems may feel familiar, but they’re now the source of most operational risks in commercial lending:

Manual workflows and outdated systems create more vulnerabilities than they prevent. From human errors and compliance oversights to slow loan processing and operational bottlenecks, the risks of inaction are mounting.

— GoDocs Playing It Safe Guide, 2025Manual Processes Fail Lenders When There Are Economic Fluctuations

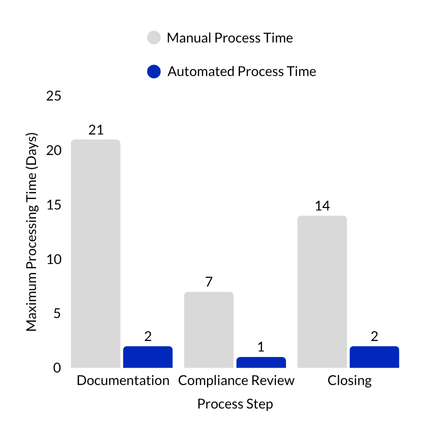

Manual loan processing is time-consuming, often taking weeks for lenders to close loans and delaying time to cash. These delays have a real financial impact when volume peaks.

These typical processing times often assume a normal lending climate. How about when there are major changes, like we’re seeing with the 2025 maturity wave?

In 2025, approximately $957 billion in commercial mortgages is due for refinancing, representing about 20% of the $4.8 trillion in outstanding commercial loans.

— GoDocs Market Insights, 2025This unprecedented volume of maturing loans is both a challenge and an opportunity. Borrowers will need fast, flexible refinancing. For lenders bogged down with manual processes, their bandwidth to successfully serve these prospective borrowers doesn’t exist. For lenders who’ve proactively automated their loan closing process, they’re apt to win market share.

Market Shifts That Require Agile Processes

DSCR Loan Rate Drops

DSCR loan rates dropped from 8.73% to 7.76% in 2024. What does this imply for commercial lenders? Lenders are earning less per dollar on each individual loan from compressed loan margins.

Declining rates on long-term DSCR loans suggest increased competition and a stronger borrower profile, while persistently high short-term loan rates highlight the importance of strategic financing decisions.

— GoDocs Market Insights, 2025Simultaneously, average loan amounts are rising (from $329,294 to $354,931), and lower rates encourage more borrowers to take out loans (increased loan volume).

Commercial lenders who can take on increased loan volume are able to offset lower profit on each dollar lent, further encouraging lenders to automate processes to service borrowers faster while taking on more customers.

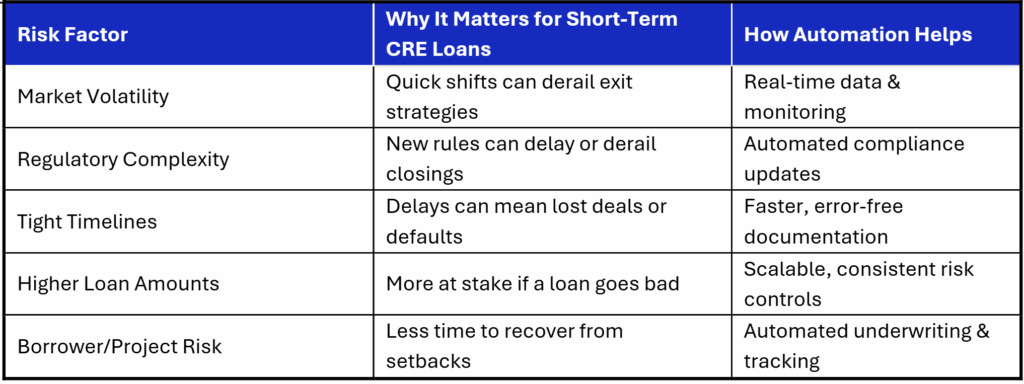

Short-Term CRE Loan Trends

These loans are riskier and more sensitive to economic shifts, so robust risk management and fast, accurate processing are critical. Higher rates on short-term loans mean higher returns per loan, and the continued demand (as shown by loan values peaking at $745,793) means a healthy market for these products.

Loan values for both categories have seen upward trends, signaling growing confidence in commercial real estate transactions.

— GoDocs Market Insights, 2025Short-term loans have their own nuances which bring anxiety to those who manually process them. These loans are more sensitive to rate changes, which can impact the cost of refinancing or the attractiveness of a property. Further, new compliance requirements can add complexity, cost, or delays, especially if lenders are using manual processes.

Commercial Lenders Who Automate Will Thrive

These trends are good for lenders who are ready to scale, but only if they modernize. Automation is no longer a “nice to have,” it’s the only way to stay profitable, compliant, and competitive as the market grows in both size and complexity.

Modernization reduces, rather than increases, risk. Clinging to outdated processes and technologies exposes lenders to unnecessary errors, compliance failures, and operational inefficiencies.

— GoDocs Playing It Safe Guide, 2025CEO

Experience the Future of Commercial Loan Document Automation

Discover GoDocs, the leading SaaS solution powered by the sharpest legal minds in CRE! Schedule a demo today to elevate your lending process and to gain your competitive advantage.