Myth 1: Faster closing document preparation means higher compliance risk.

Legacy loan closing systems have created misconceptions about what’s possible in commercial loan documentation. In

Product

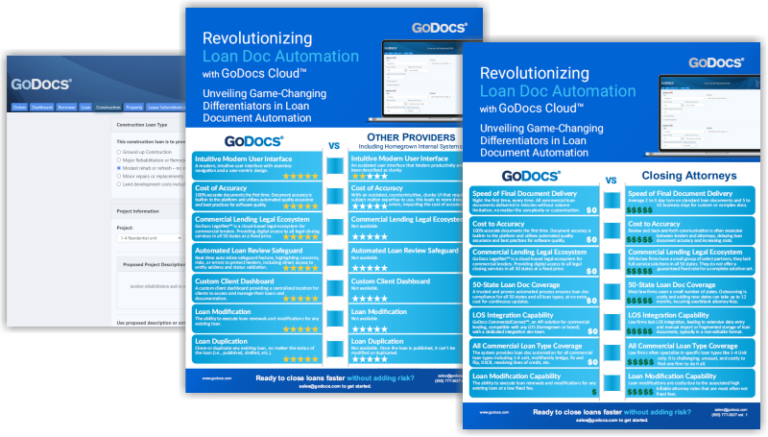

Integrating with your existing LOS, GoDocs provides an automated SaaS solution for generating attorney-quality closing documents in minutes.

Committed to our customers’ security: With our SOC 2 Type II certification, you can trust your data is shielded beyond traditional safeguards, ensuring the highest level of data security and reliability.

Learn moreSolutions

GoDocs modernizes commercial loan closings and makes the process of reviewing the ever-changing legal and regulatory landscape simple.

By leveraging the right strategies, financial institutions can not only weather the storm but position themselves as leaders in the market.

Learn moreLenders

Commercial lenders using GoDocs gain a faster, more reliable solution that delivers consistent, accurate, and fully compliant documents

Our latest Budget Playbook for Commercial Lenders was crafted to help banks and credit unions find answers. In it, we delve into the most pressing challenges facing commercial lenders today with a practical guide to help your institution thrive, regardless of market volatility.

Learn moreAbout Us

GoDocs puts lenders in control of the lending process and eliminates the stress of generating consistent quality commercial closing documents.

Discover the full potential of your commercial lending operations with our comprehensive guide.

Learn moreResources

Founded by legal and SaaS experts, GoDocs provides insights into commercial lending trends and resources to help your organization stay ahead of market shifts.

View All ResourcesOur latest Budget Playbook for Commercial Lenders was crafted to help banks and credit unions find answers. In it, we delve into the most pressing challenges facing commercial lenders today with a practical guide to help your institution thrive, regardless of market volatility.

Get the Playbook

Automated loan docs in minutes for all loan types, including Table Funding, DSCR, Non-QM, Multifamily, 1-4 Unit, 5+ Rental, Build-to-Rent (BTR), Single Family Rental (SFR), CDFI, Ground-Up, Fix and Flip, Bridge, New Construction, and Fix-to-Rent, no matter the complexity.

GoDocs provides the scalability to handle the demand of fluctuating loan volumes seamlessly without adding or reducing staff.

Streamline compliance, real-time updates, and cost savings — the only solution for always-compliant 50-state doc gen for a focused approach on core operations.

Maximize productivity and loan volume, reallocating valued resources to higher-value areas for accelerated expansion and superior outcomes.

GoDocs LegalNet™ — seamlessly integrates compliance, documentation, and closing services through a secure network of specialized legal experts.

Download the Competitive Comparison

Experience the power of GoDocs, a cutting-edge lending solution meticulously crafted for private lenders, enabling them to effortlessly capture today’s competitive market share while seamlessly maintaining business operations.

Discover the unparalleled power of GoDocs, the ultimate solution for private lenders

Trusted by industry-leading lenders, including eight of the top 100 banks and credit unions of all sizes.

A remarkable shift is taking place as banks tighten their lending requirements. This shift has created a unique opportunity for private lenders to expand their presence and gain market share by filling the gap.

Uncover the indispensable roadmap to success for private lenders to push forward, as banks pull back, in our must-experience webinar. Delve into the 10 essential requirements, gain a profound understanding of their impact, witness a compelling use case story for each, and experience the solution that will revolutionize your lending practices.

Discover how GoDocs’ loan document automation empowers lenders to improve efficiency, ensure compliance, and reduce the closing process time and effort, all while improving the customer experience. Embrace the transformative power of automation to transform your commercial lending processes.

Uncover the secrets to market domination!

Address 7 critical questions for success in private lending today, as banks pull back from their traditional lending.

Don’t miss out on the intel that will shape your strategies and secure your market share.

Legacy loan closing systems have created misconceptions about what’s possible in commercial loan documentation. In

A wave of unsettling news recently hit the regional banking sector. Zions Bancorporation announced a

Why Commercial Lenders Deserve Better Than Legacy Doc Prep We all settle for “fine” more

Use the search bar below to help find what you’re looking for.