Documenting a complex loan without the right support can be a logistical nightmare. Recently, a California-based Lender encountered this challenge with a portfolio bridge loan.

This blog post dives into how GoDocs helped them navigate this complex situation and streamline their loan closing process.

The Problem

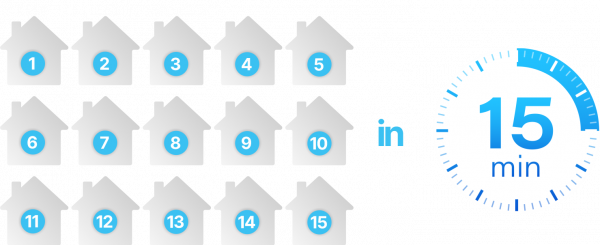

A major Lender in California was working with a loan that involved a portfolio bridge loan which consisted of 15 mortgages. All mortgages in this package would be cross-defaulted and cross-collateralized. This approach would ensure that the Lender was properly protected if any of the mortgages were to default or have collateral issues. The remaining 14 mortgages would be in place to protect the Lender’s position and mitigate risk exposure.

Historically, complex transactions like this inundated the Lender with paperwork, leading to inefficiencies and frustrations. The General Counsel at the Lender characterized these transactions as “very chaotic from a document side.”

The Solution

Seeking to enhance their complex loan documentation process, the Lender partnered with GoDocs to transform their loan document preparation. GoDocs automated all the necessary documents for this intricate transaction, ensuring appropriate cross-referencing to mitigate risks effectively. The user-friendly, cloud-based platform facilitated the assembly of documents clause-by-clause, tailored to transaction terms, thus ensuring alignment with the lender’s requirements.

2024 Commercial Lender’s Guide to Automating the Complex Loan

The Results

By leveraging GoDocs’ SaaS closing platform, the Lender was able to automate loan documents for all 15 loans in just 15 minutes, transforming what would have been a cumbersome process into an efficient and streamlined experience. The Lender’s General Counsel emphasized, “GoDocs actually made it a smooth process.” The comprehensive automation provided by GoDocs’ cloud-based platform enabled the Lender to save time, minimize errors, ensure compliance, and expedite the processing and closing of the portfolio bridge loan—all within the platform’s document automation capabilities. This efficiency demonstrates the power of GoDocs’ solution to handle even the most complex transactions seamlessly.

GoDocs' Impact

By providing a comprehensive solution tailored to the lender’s needs, GoDocs not only streamlined the loan documentation process but also empowered the lender to handle future complex transactions easily and confidently. This successful collaboration highlights the transformative potential of innovative tools like GoDocs in advancing the way financial institutions manage and execute intricate transactions, ultimately driving efficiency, accuracy, and client satisfaction.

Explore More Use Cases

Experience the Future of Commercial Loan Document Automation

Discover GoDocs, the leading SaaS solution powered by the sharpest legal minds in CRE! Schedule a demo today to elevate your lending process and to gain your competitive advantage.