Too many industries have dug in their heels against automation for too long, including CRE. Evolving into a digital and automated landscape is a must at this point. Here’s why:

Your competition is evolving.

The last thing you want is to get left behind. Your competition is adopting innovative technologies, so don’t be late for the game.

You’ve got escalating costs.

Attorneys cost money, and complex loans can escalate those costs. With an automated approach, you can better control costs and have cost transparency on your “attorney” needs in closing.

The “Human Error” element.

Human error is inevitable. Even the most experienced attorneys and their paralegals can make mistakes. Automation eliminates this long-standing pain point in business.

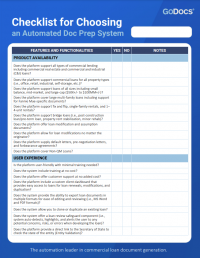

NEW Checklist for Choosing an Automated Doc Prep System

Use this complete checklist to help evaluate and compare different automated loan doc systems for your needs.

Negotiations.

Minimizing negotiations. Back-and-forth negotiations run up the attorney tab and can be very costly to the borrower. Reducing the need for extensive and ongoing negotiations makes lenders more attractive to customers.

Borrower demand.

It’s the new millennium. Your customers expect automation and the speed and ease that comes with it. In this day and age, sticking with the analog equates to bad customer service.

Schedule a custom demo to learn more about GoDocs’ digital solution for commercial loans.

Myth 2: Closing document customization requires outside counsel.

Legacy loan closing systems have created misconceptions about what’s possible in commercial loan documentation. In

What Ted Lasso Can Teach Us About Lending Technology

Be Curious, Not Judgmental There’s a moment in Ted Lasso that every leader should remember.

Myth 1: Faster closing document preparation means higher compliance risk.

Legacy loan closing systems have created misconceptions about what’s possible in commercial loan documentation. In