In today’s rapidly evolving private lending industry, a remarkable shift is taking place as traditional banks tighten their lending requirements. This shift has created a unique opportunity for private lenders to expand their presence and gain market share by filling the gap left by the restrictive policies of banks. As borrowers face more hurdles in obtaining loans from traditional sources, private lenders step in to bridge the lending divide. By offering more flexible lending options and creative solutions, private lenders are meeting the growing demands of borrowers while remaining competitive in a tightening margin environment. This expanded market, once solely dominated by banks, now provides an opportune environment for private lenders to establish cutting-edge automation workflows to meet the abundant demand of borrowers seeking financing. However, to seize this opportunity, private lenders must demonstrate their ability to meet the loan documentation requirements that were traditionally associated with bank loans.

Seizing a ‘Once-in-a-Generation’ Opportunity

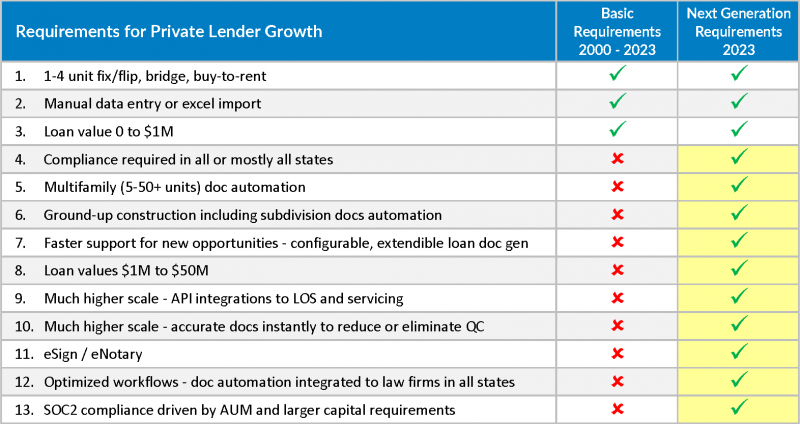

To seize this once-in-a-generation opportunity, private lenders need to address the shortcomings of first-generation loan document automation solutions. While these solutions have provided some benefits, they are no longer sufficient to meet the evolving requirements and complexities of the industry. The private lending sector has witnessed significant growth and expansion, with lenders operating in multiple states and offering a wide range of loan products. As a result, the need for accurate and compliant loan documentation and the ability to streamline workflows, integrate with existing platforms, and ensure data security has become paramount.

A top private lending customer skyrocketed productivity by an astounding 8x, all while reducing team size by 2/3 — a remarkable transformation!

By embracing a next-generation loan document automation platform, private lenders can effectively navigate the changing landscape. These advanced platforms offer the flexibility, scalability, and integration capabilities required to meet the diverse needs of modern private lenders.

Private Lender Essentials: Addressing Critical Questions for Market Shift and Market Share Gain

In the ever-evolving landscape of the private lending industry, staying ahead of the curve is essential for private lenders to thrive and succeed. As the market undergoes a significant shift, private lenders must navigate various challenges and seize opportunities to gain a larger market share. To achieve this, it is crucial for them to address seven critical questions that can shape their strategies and operations. By delving into these questions and finding effective solutions, private lenders can position themselves for success in the competitive marketplace and capitalize on the changing dynamics to gain a significant market share.

Get the White Paper!

Next-Generation Loan Document Automation in Private Lending

As banking restrictions increase need, private lending first-gen solutions fall short in meeting new requirements. Get the facts.

Private Lender Essentials: 7 Critical Questions to Address Today

- What is the cost and time to build loan document automation for new states?

- What is the cost and time to build loan document automation for multi-family loans (5-50 units)?

- What is the cost to manage document compliance in all states and for all products?

- What is the cost to build digital workflows (integrate doc automation to LOS and Servicing platforms)?

- What is the cost to order and QC loans to 100% accuracy at high scale (500, 1000, 2000 loans per month)?

- Are security and best practices (SOC2) in place for loan values of $5M, $10M, $25M?

- Are external legal services available in all states that exclude the cost for docs?

As private lenders evaluate the seven critical questions outlined above, it becomes essential to assess their readiness, preparedness, and ability to provide answers. The answers to these questions serve as the foundation for success in an ever-evolving market. Having a clear understanding of the costs and time involved in building loan document automation for new states, multi-family loans, and managing document compliance is crucial.

Additionally, the ability to seamlessly integrate digital workflows, ensure order and quality control at scale, implement robust security measures, and access external legal services can significantly impact a lender’s competitiveness. Being well-equipped with comprehensive solutions to address these challenges is not just advantageous; it is imperative for private lenders to thrive in today’s dynamic lending landscape.

In just 3 months, a top private lender seamlessly expanded its product line, incorporating Bridge, Fix & Flip, and Ground-Up Construction loans. An impressive and practically effortless feat.

Navigating the New Landscape

10 Essential Requirements for Private Lenders’ Loan Documentation Platform

In order to sustain rapid growth, outpace aggressive competition, thrive in a challenging margin environment, and attract commercial customers who find traditional banks overly restrictive, private lenders face a set of crucial requirements for their loan documentation platform. These requirements, highlighted in yellow, encompass at least 10 key elements that are essential for success.

Contact us today to learn how GoDocs handles next-gen loan doc automation in private lending.

Pioneering Private Lending: GoDocs Sets the Standard with Industry-Leading Loan Document Automation Solution

In the ever-evolving world of private lending, GoDocs loan document automation solution, empowered by its innovative GoDocs LegalNet™ ecosystem, stands as the unparalleled technology that addresses the pressing requirements faced by private lenders today.

With banking restrictions and market shifts prompting the need for transformation, GoDocs is at the forefront, providing the necessary tools and capabilities to navigate this new landscape.

By leveraging GoDocs’ cutting-edge solution, private lenders can seamlessly transition to next-generation operations, achieving unparalleled efficiency, compliance, and scalability. As the industry’s sole technology platform designed to meet these evolving demands, GoDocs enables private lenders to thrive and excel in an increasingly competitive market, empowering them to seize opportunities and secure their position as leaders in the lending industry.