The Role of Automation in Commercial Lending Whitepaper →

The commercial lending landscape is evolving rapidly, with 2025 poised to be a critical year for lenders to not just survive but thrive. Market shifts, regulatory changes, and growing borrower expectations demand innovative solutions. But thriving in this environment means more than waiting for better market conditions—it requires taking action now to streamline processes and strengthen operations.

Automation is one of the most impactful steps lenders can take to position themselves for growth. Relying on manual workflows and outdated systems not only limits scalability but also slows operations and creates unnecessary risks. By embracing automation, lenders can reduce costs, improve efficiency, and deliver faster, more accurate results for borrowers.

Automation: A Clear Path Forward

Automation addresses these inefficiencies and delivers significant benefits:

- Cost Reductions and Operational Efficiencies: Automation lowers costs by reducing manual labor and streamlining workflows.

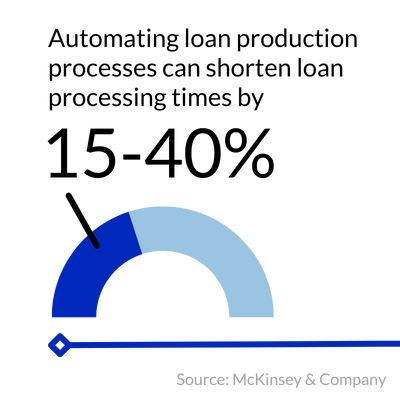

- Faster Processing Times: Automating loan production can improve processing speeds by 15%-40%, allowing lenders to serve borrowers more quickly.

- Enhanced Borrower Satisfaction: Streamlined, error-free experiences lead to better outcomes for lenders and borrowers alike.

- Improved Compliance and Accuracy: Automation minimizes human error and keeps organizations up-to-date with regulatory changes, reducing risk.

Learn More in Our Automation Whitepaper

Curious about how automation can transform your lending processes? Our whitepaper, The Role of Automation in Commercial Lending, explores these challenges in depth and provides actionable insights to help your organization take the first steps toward automation.

Curious about how automation can transform your lending processes? Our whitepaper, The Role of Automation in Commercial Lending, explores these challenges in depth and provides actionable insights to help your organization take the first steps toward automation.

Download the whitepaper now to learn:

- How automation addresses inefficiencies in loan processing

- The real-world benefits for lenders and borrowers

- Key strategies for implementing automation successfully, including the role of tools like GoDocs

It’s time to move past traditional workflows and embrace a more efficient, scalable future in commercial lending. Download the whitepaper today!

Download the Whitepaper

Experience the Future of Commercial Loan Document Automation

Discover GoDocs, the leading SaaS solution powered by the sharpest legal minds in CRE! Schedule a demo today to elevate your lending process and to gain your competitive advantage.