New MBA Stats Reinforce the Loan Modifications Demand

Are you prepared for the influx of loan modifications?

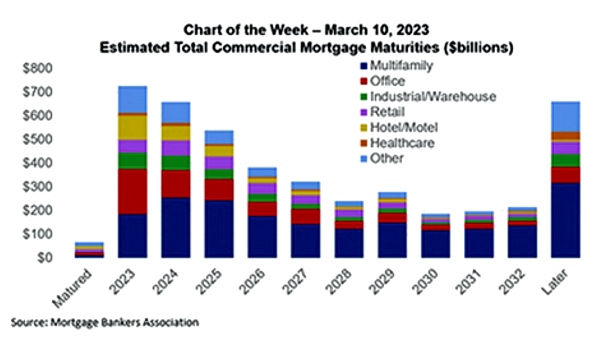

The Mortgage Bankers Association (MBA) recently released the results of its latest survey that examines the upcoming maturities of commercial and multi-family loans. All of the data is collected from loan services, including non-bank lenders.

What does your contribution look like?

According to the results, 16% or $728 billion in outstanding multi-family and commercial mortgages will mature in 2023. An additional 15% or $659 billion will mature in 2024. These numbers are unsurprising considering the increase in demand for loan modifications that has been a trend in 2023.

Essentially, the demand for new housing has plateaued along with rent rates, and borrowers and lenders are looking for creative ways to modify loans and experience some short-term relief that will prevent defaults. It is in both the lender and borrower’s best interest to avoid property foreclosures and find more lucrative solutions. Creative loan modifications are necessary to provide viable options for the borrower; however, these loan modifications can be complex, especially considering the amount of loans that are maturing.

View the Guide Instantly

Click through to instantly view the Commercial Lender’s Guide: Shifting Focus in Today’s Market

Revolutionizing Loan Modifications

ModDocs® Offers Rapid, Affordable, and Automated Alternatives to Traditional Attorney-Intensive Processes

When loans necessitate modifications, the current traditional approach involves utilizing attorneys to handle and manage loan adjustments. Although this legacy process is widely trusted, employing attorneys for such modifications can be both expensive and time-consuming. This process may involve an initial waiting period before commencing the loan modification, extensive editing, multiple iterations due to back-and-forth negotiations, and the rectification of data entry errors, which happen more frequently than lenders would like. Furthermore, given the sheer volume of loans requiring modifications, the workload on these attorneys can become overwhelming, ultimately leading to a higher probability of errors and impacting the overall effectiveness of the process.

The ROI of It All

ModDocs® is essential to loan modification success.

Fortunately, ModDocs® offers an automated solution that can handle these complexities more accurately and affordably than an attorney. All the complexities are built into the system. With other systems, attorneys are still required to further develop the loan documents, but ModDocs® can handle all the necessary documentation on its own, and then some.

ModDocs® accelerates loan doc modification at a fraction of what attorneys charge. It works regardless of the attorney or system used to draft the original docs. With a perfected product, GoDocs offers an excellent alternative to risky in-house forms as lenders look to extend maturity dates, adjust rates, change loan types, transfer to different borrowers, or change underlying collateral like adding cash agreements. For any scenario, any complexity, ModDocs® has the functionality to execute.

Lenders must prepare themselves for an influx of loan modifications as the commercial real estate market shifts. In this regard, high-quality loan modification automation is the solution. However, the need for loan automation technology extends beyond the current market conditions.

Using attorneys for loan modifications is expensive, and it can eliminate a significant portion of a lender’s profits. In contrast, loan modification software, such as ModDocs®, can eliminate attorney fees for the thousands of loans a lender may need to modify in a year. This can significantly impact the bottom line, making it an attractive proposition for any lender.

In addition, the back-and-forth process of traditional loan modification processes can be time-consuming and costly. The queue of loans, redlines, and critical loan modification workflow steps associated with legacy processes result in significant time and expense. Adopting loan automation technology can significantly reduce these costs.

Another area that poses a significant risk in commercial loan document processing is human error. Even with the use of attorneys, there is a chance of making mistakes during the loan processing stage. While this is a common problem in all businesses, it becomes particularly troublesome when trying to modify loans that have already been processed with such mistakes. Errors such as missing or incorrect property descriptions, miscalculations of closing costs and prorations, missing or incorrect signatures, and inadequate disclosure can lead to costly delays and legal complications.

The state of the commercial real estate market increases the need for loan modifications, and attorneys may struggle to keep up with the high volume, resulting in bottlenecks. Furthermore, traditional loan modification processes are prone to human error, leading to mistakes in loan processing. The likelihood of errors increases when the volume of loans is high, and human resources are overwhelmed.

The ROI Business Case Breakdown

If we look at MBA’s ‘Estimated Total Commercial Mortgage Maturities’ chart and examine only 50% of the multifamily loans scheduled to mature in 2023 and project their modification, we arrive at an estimate of 44 million loans. If we compare the average cost of attorney-assisted loan modification at $2,000 per loan with automated modification at $500 per loan, we can potentially achieve a pass-through profit (cost reduction) of $66 million for 44 million loans. This underscores the superiority of automation in achieving significant cost savings.

If we look at MBA’s ‘Estimated Total Commercial Mortgage Maturities’ chart and examine only 50% of the multifamily loans scheduled to mature in 2023 and project their modification, we arrive at an estimate of 44 million loans. If we compare the average cost of attorney-assisted loan modification at $2,000 per loan with automated modification at $500 per loan, we can potentially achieve a pass-through profit (cost reduction) of $66 million for 44 million loans. This underscores the superiority of automation in achieving significant cost savings.

In contrast, loan automation software is infinitely scalable and not error-prone. By automating the loan modification process, lenders can streamline their operations and ensure a more efficient and accurate loan processing experience.

Time is ticking. Are you ready?

With the number of loans maturing over the course of the next couple of years, time is of the essence and automation is imperative. Loan modification automation empowers lenders by providing them with advanced technology that can quickly handle a high volume of loans when lenders and borrowers need them most.

With the number of loans maturing over the course of the next couple of years, time is of the essence and automation is imperative. Loan modification automation empowers lenders by providing them with advanced technology that can quickly handle a high volume of loans when lenders and borrowers need them most.

Shifts in the market, combined with over a trillion dollars in commercial loans maturing in 2023, have intensified the need for automated documentation generation solutions. Loan modifications are the key to avoiding defaults and ModDocs® is making it possible for automation to handle even the most complex modifications while also reshaping the lending space.

Loan Modifications at a Fraction of the Cost, No Matter the Origination

The GoDocs ModDocs® solution accelerates loan doc modification at a fraction of what attorneys charge. It works regardless of the attorney or system used to draft the original docs. With a perfected product, GoDocs offers an excellent alternative to risky in-house forms as lenders look to extend maturity dates, adjust rates, change loan types, transfer to different borrowers, or change underlying collateral like adding cash agreements. For any scenario, any complexity, GoDocs has the built-in functionality to execute.

Myth 1: Faster closing document preparation means higher compliance risk.

Legacy loan closing systems have created misconceptions about what’s possible in commercial loan documentation. In

What Zions and Western Alliance Teach Us About Documentation Risk

A wave of unsettling news recently hit the regional banking sector. Zions Bancorporation announced a

A Lesson From Ted Lasso’s Roy Kent: Don’t You Dare Settle for “Fine”

Why Commercial Lenders Deserve Better Than Legacy Doc Prep We all settle for “fine” more