The private lending industry has been thriving, demonstrating remarkable growth and branching out into various loan types and lending scenarios. From ground-up construction to subdivision development, 5 or more-unit apartment buildings, land transactions, and even more unique borrower ownership scenarios, private lenders are venturing into diverse expansion areas.

This trend is set to continue as traditional banks tighten their lending criteria, presenting a once-in-a-generation opportunity for private lenders to attract a multitude of new customers. However, seizing these opportunities requires the ability to support different loan types, loan values, and compliance requirements.

Seizing a ‘Once-in-a-Generation’ Opportunity to Acquire New Customers and Drive Growth

In the year 2023, many private lenders have expanded their operations to cover all 50 states, offering a wide range of loan products and handling substantial loan volumes. With some lenders offering 10 or more loan products and closing several hundred loans per month, their ambitious goal is to reach thousands of closed loans monthly. The capital and market potential are abundant, providing ample opportunities to achieve these objectives.

The Evolution: From Limited Scope to Expansive Growth

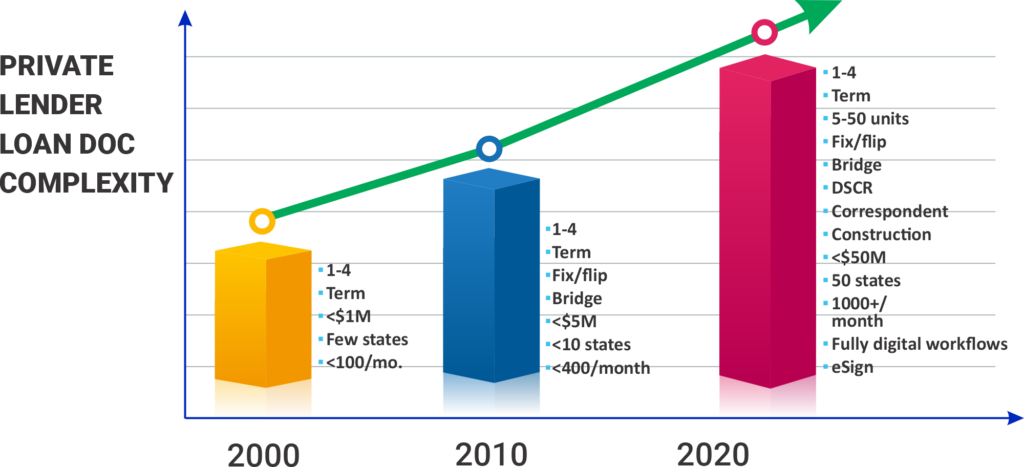

In the years spanning from 2000 and 2010, private lender operations followed a limited scenario, offering a narrower range of loan options compared to today. During this period, private lenders primarily focused on term and 1-4 family loan offerings. They typically executed loans valued under $1 million and operated within a limited number of states. With lending volumes averaging below 100 loans per month, private lenders operated on a smaller scale, catering to a specific market segment. However, as the lending landscape evolved, private lenders recognized the immense opportunity for growth and expansion in the industry.

GoDocs customers achieve 5-7x productivity and 3x loan volume by effortlessly expanding loan types and entry into new states with seamless automation.

Between 2010 and 2020, private lender operations underwent significant evolution, expanding in several key ways. During this period, private lenders started offering fix and flip financing and bridge loans. The also advanced to loans valued at less than $5 million, catering to a broader range of borrowers with varying financing needs. Additionally, they expanded their lending coverage to more states (i.e., 10 states), allowing them to tap into new markets and serve borrowers in more regions. Another notable development was the increase in monthly loan volumes, with some private lenders handling up to 400 loans per month. This expansion in loan size, geographical coverage, and loan volume marked a period of substantial growth and market penetration for private lenders, positioning them as key players in the lending industry.

Get the White Paper!

Next-Generation Loan Document Automation in Private Lending

As banking restrictions increase need, private lending first-gen solutions fall short in meeting new requirements. Get the facts.

Expanding Amid Market Shifts

With GoDocs, a top private lending customer has one loan processor that effortlessly handles 100 loans monthly. Attorneys pale in comparison.

Fast forward to today, 2023, private lenders have experienced a substantial expansion in response to market and banking restrictions. They have diversified their operations in various ways to meet the evolving demands of borrowers. Private lenders are now offering, or are in the process of offering, loan types that encompass properties ranging from 5 to 50 units, catering to multi-unit residential investments.

They are also venturing into DSCR lending. Private lenders are embracing correspondent lending and the expansion of construction lending, including Build-to-Rent (BTR).

Loan values have soared, with private lenders now handling loans up to $50 million and even greater amounts. Geographical coverage has expanded further, with private lenders now operating, or looking to operate, in all 50 states, enabling borrowers nationwide to access their services. As a testament to market demand, large private lenders are closing over 1,000 loans per month, demonstrating their increased lending volume and market presence.

Contact us today to learn how GoDocs

handles next-gen loan doc automation in private lending.

To adapt to the changing landscape, private lenders are evolving and have a need to expand with digital solutions, including eSign, to streamline the loan process and enhance efficiency for both borrowers and lenders. This comprehensive expansion in loan types, loan values, geographical coverage, loan volume, and digital solutions showcases the continued demand for technology for lenders to progress and succeed in the current lending landscape.

Gaining a Competitive Edge with GoDocs

To maintain or gain the competitive edge and strive to be #1 in the lending industry, private lenders must continually adapt and evolve. Embracing next-generation technologies and solutions becomes imperative, and that includes harnessing the power of the loan document automation ecosystem offered by GoDocs. By leveraging GoDocs’ cutting-edge automation tools, private lenders can streamline their loan document processes, improve efficiency, reduce errors, reduce resources, and enhance operations to handle any loan type, any loan size, and any loan volume while mitigating risk automatically.

Futureproof Commercial Lending: Complex Loan Automation

Commercial banking institutions that fail to embrace automation for their complex loans are missing out on a crucial competitive advantage.

Major Private Lender Deploys Compliant New Pricing Structure with GoDocs

Discover in-depth insights in this blog post as we analyze a compelling real-world customer use

Why Commercial Banking Institutions Should Futureproof Now

To stay competitive and to futureproof operations, lenders must adopt innovative strategies that streamline processes, ensure compliance, enhance efficiency, and improve customer experiences.