Banks, Credit Unions, and Private Lenders

In today’s financial landscape, the journey towards digital transformation is rapidly reshaping the world of commercial lending. Here we will take a detailed look at the current state of digital transformation among the leading commercial lending verticals. It’s a landscape where banks, credit unions, and private lenders are all navigating their unique paths, each encountering distinct challenges and opportunities.

Let’s explore the progress made by these commercial lenders in embracing digital technologies to enhance their commercial lending operations. From traditional banks grappling with regulation and change management to credit unions focused on member experiences and efficiency, and private lenders spearheading innovation — this analysis looks into their digital transformation journeys in 2024 and the implications for the commercial lending industry.

1.

Current State of Digital Transformation for Banks

Banks in commercial lending have made significant strides in their digital transformation journey, often outpacing their counterparts in credit unions and private lending. However, they grapple with a unique set of challenges, primarily stemming from the complex and heavily regulated nature of the banking industry. The red tape, stringent compliance requirements, and change management processes inherent to banks can slow down innovation and hinder their ability to adapt swiftly to emerging technologies.

Despite these challenges, encountered, banks have significantly committed to digital transformation, as revealed in Engage’s 2024 report. It states that “In 2024, 95% of banking leaders are directing their investments towards technologies geared at enhancing communication, automating processes, and enhancing employee experiences.”

While they may face initial hurdles, banks’ commitment to digital innovation ultimately positions them ahead of credit unions and private lenders in leveraging technology to enhance commercial lending operations.

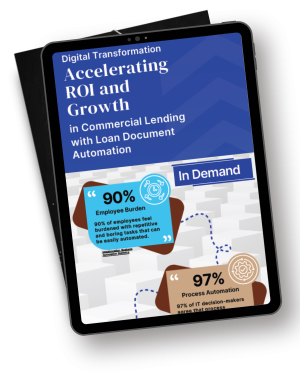

Experience ROI and Growth Get the Facts!

See how top commercial lenders experience true ROI and growth by investing in digital technologies.

Download the infographic.

2.

Current State of Digital Transformation for Credit Unions

Per CUInsight, they highlight that “Despite the increasing focus of credit unions on digitization, consumers consistently perceive large national banks as providing superior digital experiences.” Nonetheless, credit unions remain steadfast in their determination to narrow this disparity, placing a high priority on efforts to catch up and improve their digital services.

In commercial lending technology, credit unions are specifically concentrating on enhancing member experiences and simplifying the loan application process through digital channels. However, they also recognize that the back end of the lending process is just as important as the front end, and automating their closing process is a critical component of the digital transformation journey. This holistic approach ensures that they provide a seamless experience for borrowers while improving operational efficiency and positioning themselves as agile and customer-centric players in the industry.

3.

Current State of Digital Transformation for Private Lenders

Private lenders in commercial lending are at the forefront of innovation like they’ve never been before. Digital transformation holds the key to their continued success in 2024. These lenders, often characterized by their agility and flexibility, can harness digital technologies to further expand their market presence and capitalize on emerging opportunities. By adopting automation and digital platforms, private lenders can streamline loan document generation, facilitating quicker closings and improved operational efficiency.

The adoption of digital solutions also enables private lenders to target thriving markets with precision, adapt to changing borrower preferences, and maintain a competitive edge against larger financial institutions. In a landscape where speed and convenience are paramount, digital transformation not only meets borrower expectations but also allows private lenders to differentiate themselves in the market. As they navigate the dynamic commercial lending ecosystem of 2024, private lenders embracing digital technologies are well-positioned to thrive and seize new avenues for growth.

Chasing Innovation

The Ongoing Pursuit in Commercial Lending's Digital Transformation

In commercial lending, the journey of digital transformation is far from reaching its final destination. As we’ve explored the diverse paths of banks, credit unions, and private lenders, one thing becomes abundantly clear: the pursuit of innovation is at the heart of this industry’s future.

Banks, with their steadfast commitment to overcoming regulatory hurdles, continue to pave the way for digital innovation. They’ve set their sights on a more efficient and technology-driven future, promising enhanced commercial lending operations and service delivery.

As we move forward, one truth remains: digital transformation is an ongoing journey, not a finite destination. The dynamic nature of the industry demands continuous adaptation and innovation. The winners in this race will be those who embrace change, invest in technology, and stay attuned to evolving borrower preferences.

Experience the Future of Commercial Loan Document Automation

Discover GoDocs, the leading SaaS solution powered by the sharpest legal minds in CRE! Schedule a demo today to elevate your lending process and to gain your competitive advantage.

Gain a Competitive Edge with GoDocs

To maintain or gain the competitive edge and strive to be #1 in the lending industry, commercial lenders must continually adapt and evolve. Embracing next-generation technologies and solutions becomes imperative, and that includes harnessing the power of the loan document automation ecosystem offered by GoDocs. By leveraging GoDocs’ cutting-edge automation tools, private lenders can streamline their loan document processes, improve efficiency, reduce errors, reduce resources, and enhance operations to handle any loan type, any loan size, and any loan volume while mitigating risk automatically.

Futureproof Commercial Lending: Complex Loan Automation

Commercial banking institutions that fail to embrace automation for their complex loans are missing out on a crucial competitive advantage.

Major Private Lender Deploys Compliant New Pricing Structure with GoDocs

Discover in-depth insights in this blog post as we analyze a compelling real-world customer use case showcasing the effectiveness of GoDocs’ SaaS solution in partnership with

Why Commercial Banking Institutions Should Futureproof Now

To stay competitive and to futureproof operations, lenders must adopt innovative strategies that streamline processes, ensure compliance, enhance efficiency, and improve customer experiences.